Japan’s Initiatives on Revitalizing the Shipbuilding Industry

By Yosuke Yamashita

1. Introduction

Shipbuilding has been positioned as one of the key policy priorities in both Japan and the United States. In the United States, President Trump announced in his State of the Union address the establishment of a shipbuilding office within the White House and, in April 2025, signed an executive order entitled “Restoring America’s Maritime Dominance,” directing administrative agencies to formulate a Maritime Action Plan and setting forth a policy direction aimed at revitalizing the maritime industry.

In addition, as a measure under Section 301 of the Trade Act, the United States began imposing port entry fees on Chinese-built vessels in order to mitigate China’s dominance in the maritime industry, later announcing a one-year extension of the measure. Furthermore, the United States has promoted foreign investment in domestic shipyards, and in tariff negotiations with Japan and South Korea, shipbuilding has been positioned as one of the priority sectors for investment into the United States by both countries.

Japan has long pursued policies to strengthen the competitiveness of its shipbuilding industry. However, in light of these recent U.S. initiatives, Japan is now seeking to fundamentally reinforce its domestic production base. This article outlines the current state of Japan’s shipbuilding industry and examines recent developments in Japan’s shipbuilding policies.

2. Current State of Japan’s Shipbuilding Industry

As a maritime nation surrounded by the sea, Japan relies on maritime transport for nearly all of its trade. Consequently, the maritime industry—including shipping and shipbuilding—is of critical importance to Japan’s economic security.

From the 1970s through the 1990s, Japan was the world’s leading shipbuilding nation in terms of vessel construction volume. However, amid intense competition with China and South Korea in a single global market, several Japanese shipbuilders have downsized or withdrawn from commercial shipbuilding since the 2010s. As a result, both Japan’s construction volume and global market share have gradually declined. At present, Japan’s share of annual shipbuilding orders stands at around 8 percent, significantly trailing China. Moreover, the Japanese shipbuilding industry does not have sufficient capacity to meet domestic shipowners’ demand, creating the risk that Japan may be compelled to depend on other countries for vessel construction.

(Source:MLIT)

(Source:MLIT)

The Japanese government has supported efforts to strengthen the business foundations of shipbuilding companies and, based on the Economic Security Promotion Act enacted in 2022, has worked to reinforce supply chains for ship components. Nevertheless, compared with other strategically important goods such as semiconductors and critical minerals, the importance of domestic shipbuilding capacity itself has not been widely recognized, even within Japan.

Against this backdrop, and in light of efforts to revitalize the maritime industry in the United States and their underlying drivers, the continued decline in Japan’s shipbuilding capacity has come to be viewed as a threat to Japan’s economic security.

3. Japan’s Initiatives Toward Revitalizing the Shipbuilding Industry

In response to the issues outlined above, in June 2025 members of the Liberal Democratic Party submitted a policy proposal to Prime Minister Ishiba calling for the establishment of a fund on the scale of ¥1 trillion to strengthen the shipbuilding industry. Subsequently, in October 2025, Yukito Higaki, President of the Japan Shipbuilding Industry Association, stated at an LDP meeting that the industry was prepared to invest approximately ¥350 billion to double current construction volumes.

In light of these developments, the Japanese government decided to establish a fund to strengthen the shipbuilding industry, allocating ¥120 billion in the FY2025 supplementary budget enacted in December 2025 as funding for three years of support from 2026 to 2028. This represents an unprecedented scale of government support, considering that the total budget allocated for strengthening ship component supply chains under the Economic Security Promotion Act amounts to ¥9 billion.

Furthermore, the government released the Shipbuilding Industry Revitalization Roadmap at the end of 2025, setting a target of doubling domestic shipbuilding volume to 18 million gross tons by 2035 compared with 2024 levels, thereby establishing domestic capacity sufficient to meet Japanese shipowners’ demand. To achieve this goal, the government announced a policy to support capital investment by the domestic shipbuilding industry through a ¥350 billion fund implemented in three stages.

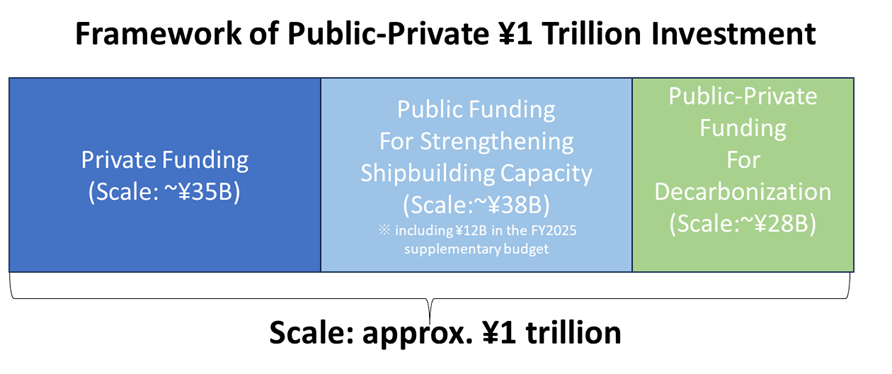

(Source: Author based on MLIT)

Specifically, the initial ¥120 billion allocated in the FY2025 supplementary budget will support automation and labor-saving measures—such as the introduction of welding robots—between 2026 and 2028. From 2029 to 2031, the plan calls for the construction and expansion of facilities such as docks, followed by support around 2032–2034 for the operation of expanded docks and long-lead-time equipment, including large-scale cranes. Including support for advanced technology development, the government has outlined a plan for combined public and private investment totaling approximately ¥720 billion.

In addition, the roadmap positions decarbonization in the maritime sector as a game-changing opportunity in the shipbuilding market. Japan aims to lead discussions at the International Maritime Organization (IMO) on the formulation of international rules, while advancing the development, demonstration, and construction frameworks for zero-emission vessels. Public and private investment of approximately ¥280 billion is expected for decarbonization-related initiatives.

(Source: Author based on MLIT)

Taken together, Japan aims to realize investment on the scale of ¥1 trillion by 2035, combining approximately ¥730 billion for strengthening shipbuilding capacity and ¥280 billion for decarbonization-related investments.

4. International Cooperation in the Shipbuilding Sector

Shipbuilding has been positioned as one of the investment areas within the $550 billion in investments from Japan agreed upon in the U.S.–Japan tariff negotiations. In October 2025, Japan and the United States signed a Memorandum of Understanding on shipbuilding cooperation, establishing a working group and identifying areas of cooperation, including the expansion of shipbuilding capacity in both countries and the promotion of investment in the U.S. maritime industrial base.

Notably, the memorandum refers not only to the expansion of shipbuilding capacity within the United States and investment in the U.S. maritime industry, but also to the expansion of shipbuilding capacity within Japan. This can be understood as reflecting the current state of Japan’s shipbuilding industry described above, and the initiatives toward revitalizing Japan’s shipbuilding industry discussed in Section 3 are consistent with this memorandum.

In addition, the roadmap calls for advancing cooperation not only under the U.S.–Japan memorandum but also with allied countries and nations in the Global South. This includes securing and developing overseas repair bases and promoting the circulation of foreign human resources—including highly skilled engineers—both within and outside Japan.

5. Conclusion

Japan remains the world’s third-largest shipbuilding nation, following China and South Korea. However, as discussed in this article, unlike China and South Korea, Japan’s shipbuilding capacity has been declining, creating the risk that Japan may be compelled to rely on other countries for vessel construction—a challenge that Japan shares in common with the United States.

Even in an increasingly digitalized world, essential goods such as food and energy cannot reach consumers without physical means of transportation. As the international environment grows more complex, the importance of autonomously securing such transportation capabilities continues to increase. Going forward, close attention should be paid to Japan’s domestic initiatives to strengthen its maritime industrial base, as well as to ongoing U.S.–Japan cooperation in this field.

References

Policy Proposal to Revitalize Japanese Shipbuilding from the Liberal Democratic Party

https://storage2.jimin.jp/pdf/news/policy/210931_2.pdf

The Shipbuilding Industry Revitalization Roadmap

https://www.mlit.go.jp/maritime/content/001975739.pdf

Basic Information and Relevant Policies on Shipbuilding

https://www.mlit.go.jp/maritime/content/001975729.pdf

MEMORANDUM OF COOPERATION Regarding Shipbuilding Between the Government of Japan and the Government of the United States of America

.png)